- Introduction

- Understanding Real Estate and Stocks

- Comparative Analysis: Real Estate vs. Stocks

- Stability and Tangibility

- Potential for Returns

- Diversification and Risk Management

- Control and Ownership

- Tax Benefits

- Factors Influencing Real Estate Investment in Pakistan

- Growing Population and Urbanization

- Economic Stability and Growth

- Infrastructure Development

- Legal and Regulatory Framework

- Real Estate Investment in Pakistan: Opportunities and Challenges

- Residential Properties

- Commercial Properties

- Industrial Properties

- Challenges Faced by Investors

- Conclusion

- FAQs

Why Real Estate is Better than Stocks

Introduction

Investing in financial markets is a popular way to grow wealth and secure a prosperous future. While stocks have long been a preferred choice for investors, an increasing number of individuals are recognizing the potential of real estate as an investment avenue. In this article, we will delve into the reasons why real estate is better than stocks and explore the unique advantages it offers. Particularly, we will focus on the context of real estate investment in Pakistan, uncovering the opportunities and challenges that exist in this dynamic market.

Understanding Real Estate and Stocks

Before delving into the comparative analysis, let’s first understand the fundamental differences between real estate and stocks. Real estate refers to physical property, including land and buildings, whereas stocks represent shares of ownership in a publicly traded company. While both can yield financial returns, they operate in distinct ways and offer unique advantages to investors.

Comparative Analysis: Real Estate vs. Stocks

- Stability and Tangibility:

One of the key advantages of real estate is its stability and tangibility. Unlike stocks, which can experience volatile price fluctuations, real estate investments tend to be more stable over the long term. Properties provide a physical asset that can withstand market fluctuations and offer a sense of security to investors. - Potential for Returns:

Real estate investments have the potential to generate substantial returns. Rental income from properties can provide a steady cash flow, while property values tend to appreciate over time. In comparison, stocks are subject to market volatility, making it difficult to predict and achieve consistent returns. - Diversification and Risk Management: Real estate allows investors to diversify their portfolios, reducing the risk associated with a single investment. By owning different types of properties in various locations, investors can spread their risk and protect their wealth. Stocks, on the other hand, are susceptible to systemic risks that affect entire markets.

- Control and Ownership: Real estate investments provide investors with a greater sense of control and ownership. Unlike stocks, where the decision-making power lies with company management, real estate allows investors to directly influence the performance and value of their assets. This control empowers investors to make strategic decisions and drive profitability.

- Tax Benefits: Real estate investments offer attractive tax benefits that can enhance overall returns. In many countries, including Pakistan, investors can deduct mortgage interest, property taxes, and other related expenses from their taxable income. Additionally, capital gains from the sale of properties may be subject to preferential tax treatment.

Factors Influencing Real Estate Investment in Pakistan

In the context of Pakistan, several factors contribute to the attractiveness of real estate investment:

- Growing Population and Urbanization: Pakistan has a rapidly growing population, leading to increased demand for housing and commercial spaces. Urbanization trends drive the need for infrastructure development and create opportunities for real estate investors.

- Economic Stability and Growth: The stability of Pakistan’s economy and its consistent growth rate makes it an attractive destination for real estate investment. Stable economic conditions provide a conducive environment for property appreciation and rental income.

- Infrastructure Development: Ongoing infrastructure development projects, such as the construction of new roads, bridges, and housing schemes, contribute to the growth of real estate. These developments enhance the value of properties and attract both domestic and international investors.

- Legal and Regulatory Framework: An effective legal and regulatory framework is crucial for real estate investments. Pakistan has been making efforts to improve its property registration systems, streamline approval processes, and strengthen investor protection laws, making it easier and more secure to invest in real estate.

Real Estate Investment in Pakistan: Opportunities and Challenges

Real estate investment opportunities in Pakistan are diverse and offer the potential for attractive returns. Some of the key areas of investment include:

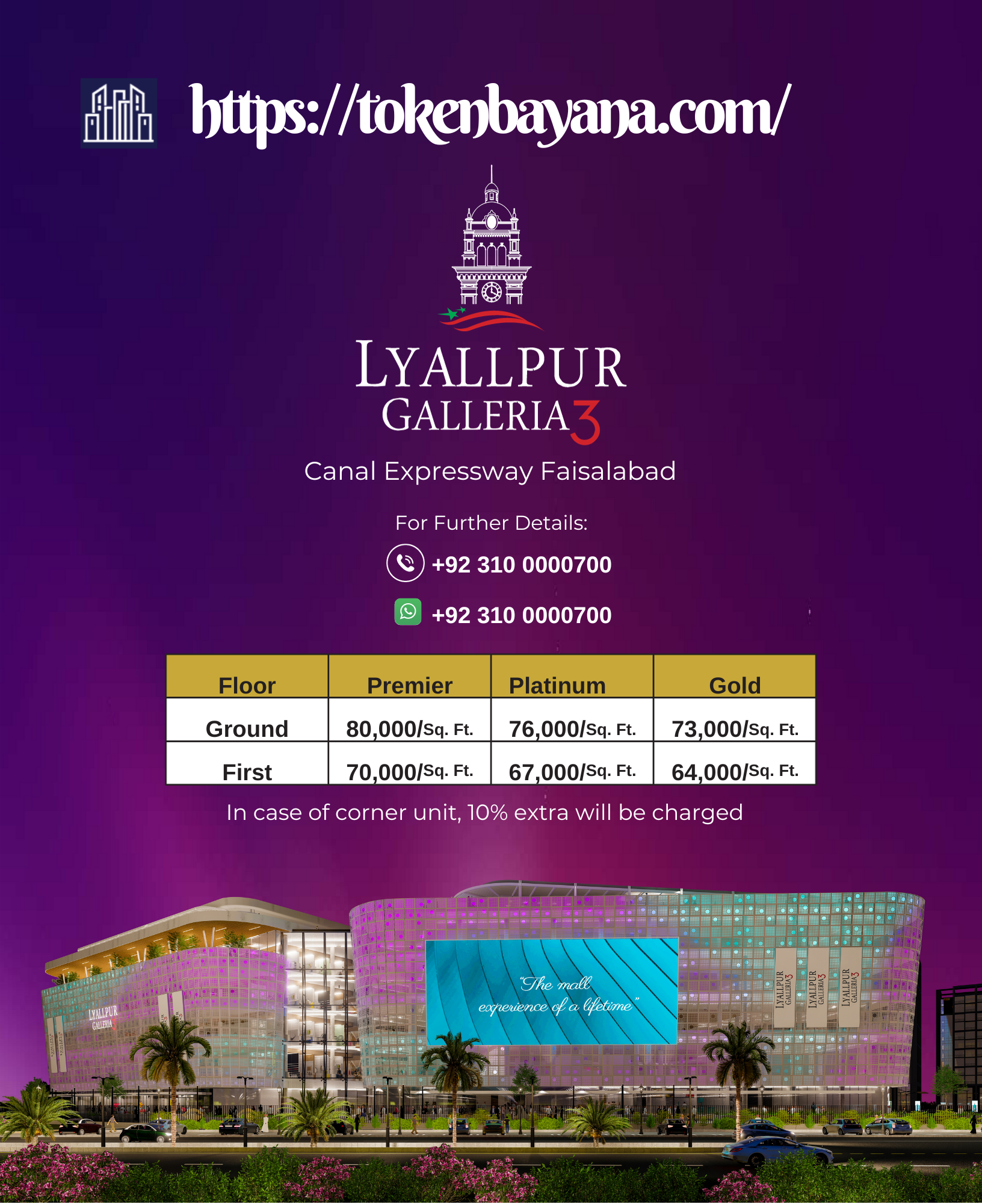

- Residential Properties: The demand for residential properties, including houses and apartments, remains strong in Pakistan’s urban centers. Increasing urbanization and rising income levels drive the need for quality housing, creating opportunities for investors to capitalize on this demand.

- Commercial Properties: Pakistan’s growing economy and the emergence of new businesses have increased the demand for commercial properties, including offices, retail spaces, and industrial complexes. Investors can benefit from rental income and capital appreciation in this segment.

- Industrial Properties: With the government’s focus on industrialization and the development of special economic zones, investing in industrial properties presents an attractive opportunity. These properties cater to the needs of manufacturing, logistics, and warehousing industries.

However, real estate investment in Pakistan also comes with its share of challenges:

- Market Volatility: Like any investment market, real estate in Pakistan can experience periods of volatility. Fluctuations in property prices and regulatory changes can impact investor confidence and require careful analysis and risk management.

- Legal and Regulatory Issues: While the legal and regulatory framework in Pakistan has improved, some challenges persist. Delays in property registration, ambiguities in land ownership, and limited transparency in transactions can pose obstacles to investors.

- Infrastructure Constraints: Despite ongoing development, infrastructure constraints remain a challenge in some areas of Pakistan. Limited access to utilities, inadequate road networks, and insufficient public amenities can affect the value and attractiveness of real estate investments.

Conclusion

Real estate investment offers unique advantages over stocks, particularly in terms of stability, the potential for returns, control, and tax benefits. In the context of Pakistan, the growing population, economic stability, infrastructure development, and favorable legal framework contribute to the attractiveness of real estate investments. However, investors must also be aware of the challenges, such as market volatility, legal and regulatory issues, and infrastructure constraints. By carefully analyzing these factors and making informed decisions, investors can leverage the opportunities and achieve long-term financial success through real estate investment in Pakistan.

FAQs

1. Is real estate a safer investment than stocks?

Yes, real estate is generally considered a safer investment compared to stocks due to its stability and tangibility. The physical nature of properties provides a sense of security and a buffer against market volatility.

2. Can real estate investment provide regular income?

Absolutely. Real estate investments, particularly rental properties, can generate regular income in the form of rental payments from tenants. This steady cash flow can contribute to a stable and predictable income stream for investors.

3. Are there tax benefits associated with real estate investment in Pakistan?

Yes, Pakistan offers various tax benefits for real estate investors. Deductions for mortgage interest, property taxes, and other related expenses can help reduce taxable income. Additionally, capital gains from the sale of properties may be subject to preferential tax treatment.

4. What factors should I consider before investing in real estate in Pakistan?

Before investing in real estate in Pakistan, consider factors such as location, market trends, infrastructure development, legal and regulatory framework, and potential returns. Conduct thorough research and analysis to make informed investment decisions.

5. What are the challenges of real estate investment in Pakistan?

Some of the challenges in real estate investment in Pakistan include market volatility, legal and regulatory issues, infrastructure constraints, and uncertainties in property transactions. It is crucial to navigate these challenges by seeking professional advice and conducting due diligence before making investments.